Pursuant to S.C. Code Ann. Section 6-1-80 (1976, as amended) and S.C. Code Ann. Section 6-1-330(A) (1976, as amended), the City Council of the City of Camden (the “City”), will conduct a public hearing (the “Hearing”) related to the City’s annual budget for the Fiscal Year 2024-2025 (both general fund and combined utility enterprise fund), which proposed budget includes the imposition of: (i) a 10% increase in volumetric charges related to the water component of the City’s combined public utility system (the “System”); (ii) a 5% increase in volumetric charges related to the sewer component of the combine public utility System; (iii) a 7% increase to the electric component of the City’s combined public utility System; (iv) and other miscellaneous fee increases for the System; and (v) a $5.00 increase to residential sanitation in the general fund; and (vi) a 5% increase to commercial sanitation in the general fund. The amounts anticipated to be raised from the imposition of the proposed rate/fee increases were not previously funded from property taxes and are not being imposed as a replacement for property taxes.

The Hearing will be held during the City Council meeting on Tuesday, April 23, 2024, at 5:30 pm in the City Council chambers, which are located at 1000 Lyttleton Street, Camden, SC. A copy of the agenda for the City Council meeting will be available here at least 24-hours in advance of the date and time for the meeting. Further information regarding the Hearing is available by submitting an email to: cityclerk@camdensc.org. Additionally, copies of the proposed FY 2024-2025 budget are available for pick up at City Hall, which is located at 1000 Lyttleton Street, Camden, SC, during regular business hours (8:15 am – 5:00 pm).

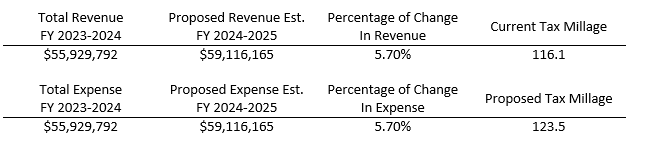

Consistent with the provisions of S.C. Code Ann. Section 6-1-80 (1976, as amended), the following information is provided with respect to the proposed FY 2024-2025 budget:

Proposed tax millage equals $123.5 per $1,000 of assessed property value. Based on preliminary assessments set by Kershaw County, South Carolina the proposed millage is estimated to produce $5,828,007 (which includes credits for Local Option Sales Tax proceeds) in total tax revenue. The proposed millage for fiscal year 2024-2025 is subject to the provisions of S.C. Code Ann. Section 6-1-320 (1976, as amended) and may be adjusted to comply with such provision.